-

Financial administration

An accurate financial administration provides you with the information you need to take the right decisions. The big advantage of a digital financial administration is that it provides insight into your most important financial processes at any time, whether this is the invoices, salary payments or bank changes.

-

Financial insight

You want to take the right decisions, based on trustworthy and clear management information. You want to have access to all your financial data, 24/7, in order to determine your position and be able to adjust where necessary.

-

Global compliance partnering

Outsourced compliance services comprises the total financial compliance of your business, in accounting, financial reporting, payroll, legal and various tax reporting obligations. We can make sure you don’t have to worry.

-

Business risk services

Minimize risk, maximize predictability, and execution Good insights help you look further ahead and adapt faster. Whether you require outsourced or co-procured internal audit services and expertise to address a specific technology, cyber or regulatory challenge, we provide a turnkey and reliable solution.

-

Corporate finance

Finding a suitable match at the most optimum terms. That, in a nutshell, aptly describes the objective of mergers and acquisitions. To most businesses mergers or acquisitions are not standard daily practice. It is, however, for the professionals at Grant Thornton! Seeking their services will add value instantly.

-

Cyber risk services

What should I be doing first if my data has been kidnapped? Have I taken the right precautions for protecting my data or am I putting too much effort into just one of the risks? And how do I quickly detect intruders on my network? Good questions! We help you to answer these questions.

-

Impact House

Building sustainability and social impact. That sounds good. But how do you go about it in the complex world of stakeholders, regulations and frameworks and changing demands from clients and society? How do you deal with important issues such as climate change and biodiversity loss?

-

Transaction services

What will the net proceeds be after the sale? How do I optimise the selling price of my business or the price of one of my business activities? How do I capitalise on synergies following an acquisition? Am I not offering too much? These are all good questions when you’re buying or selling a business. It’s a transaction that concerns significant amounts, impacts your future, and therefore must be executed properly. We provide a solid foundation for your decisions.

-

Valuation, investigation & dispute services

Do you require a fact finding investigation to help assess irregularities? Is it necessary to ascertain facts for litigation purposes?

-

Auditing of annual accounts

You are answerable to others, such as shareholders and other stakeholders, with regard to your financial affairs. Financial information must therefore be reliable. What is more, you want to know how far you are progressing towards achieving your goals and what risks may apply.

-

IFRS services

Financial reporting in accordance with IFRS is a complex matter. Nowadays, an increasing number of international companies are becoming aware of the rules. But how do you apply them in practice?

-

ISAE & SOC Reporting

Our ISAE & SOC Reporting services provide independent and objective reports on the design, implementation and operational effectiveness of controls at service organizations.

-

Pre-audit services

Pre-audit services is all about making the company’s entire financial administration ready for checking before the external accountant begins his/her audit of the annual accounts.

-

SOx law implementation

The SOx legislation dictates that management is structurally accountable for reporting on the internal control relevant to the financial statements.

-

International corporate tax

The Netherlands’ tax regime is highly dynamic. Rules and the administrative courts raise new challenges in fiscal considerations on a nearly daily basis, both nationally and internationally.

-

VAT advice

VAT is an exceptionally thorny issue, especially in major national and international activities. Filing cross-border returns, registering or making payments requires specialised knowledge. It is crucial to keep that knowledge up-to-date in order to respond to the dynamics of national and international legislation and regulation.

-

Customs

Importing/exporting goods to or from the European Union involves navigating complicated customs formalities. Failure to comply with these requirements usually results in delays. In addition, an excessively high rate of taxation or customs valuation for imports can cost you money.

-

HR services

Do your employees determine the success and growth of your organisation? And are you in need of specialists which you can ask your Human Resources (HR) related questions? Human Resources (HR) related questions? Our HR specialists will assist you in the areas of personnel and payroll administration, labour law and taxation relating to your personnel. We provide you with high-quality personnel and payroll administration, good HR guidance and the right (international) advice as standard. All this, of course, with a focus on the human dimension.

-

Innovation & grants

Anyone who runs their own business sets themselves apart from the rest. Anyone who dares stick their neck out distinguishes themselves even more. That can be rather lucrative.

-

Tax technology

Driven by tax technology, we help you with your (most important) tax risks. Identify and manage your risks and become in control!

-

Transfer pricing

The increased attention for transfer pricing places greater demands on the internal organisation and on reporting.

-

Sustainable tax

In this rapidly changing world, it is increasingly important to consider environmental impact (in accordance with ESG), instead of limiting considerations to financial incentives. Multinational companies should review and potentially reconsider their tax strategy due to the constantly evolving social standards

-

Pillar Two

On 1 January 2024 the European Union will introduce a new tax law named “Pillar Two”. These new regulations will be applicable to groups with a turnover of more than EUR 750 million.

-

Cryptocurrency and digital assets

In the past decade, the utilization of blockchain and its adoption of a distributed ledger have proven their capacity to revolutionize the financial sector, inspiring numerous initiatives from businesses and entrepreneurs.

-

Expand into new markets

Do you seek for opportunities in the global business arena? Whether you are about to open a new office in a foreign country or considering an international acquisition, you need certainty of making the right choices for your company. Global expansion isn’t always as simple as it sounds. The good thing is that we’re here to help!

-

Expanding your business in the Netherlands

International expansion is an important step. The Netherlands can be your gateway to Europe for doing business abroad. But why you should choose the Netherlands?

-

Global contacts

Wherever you choose to do business, you want access to people with the best ideas and critical thinking that will enable you to grow your business at home and abroad.

-

Corporate Law

From the general terms and conditions to the legal strategy, these matters need to be watertight. This provides assurance, and therefore peace of mind and room for growth. We will be pro-active and pragmatic in thinking along with you. We always like to look ahead and go the extra mile.

-

Employment Law

Small company or large multinational: in any company your people are of the utmost importance for your business. Employment brings with it many issues in many areas and often has legal consequences. For big strategic, but also for more everyday questions about employment law, our lawyers are ready to help you out. Also for questions about international employment law. Do you have your own HR department? We’ll gladly assist them. We deliver bespoke services and are there when you need us.

-

Specialist Areas

Besides our focus on corporate and employment law, we also advise entrepreneurs on a range of (specialist) legal issues. A corporate acquisition, your company administration, complex question in the field of healthcare issues: you have come to the right place.

-

Maritime sector

How can you continue to be a global leader? The Netherlands depends on innovation. It is our high-quality knowledge which leads the maritime sector to be of world class.

-

Growth in an international network

At Grant Thornton, you will benefit from the expertise and quality of colleagues around the world who will benefit your knowledge, advice and growth.

-

Varied customer portfolio

The customer package at Grant Thornton varies from (large) SME customers to (small) corporate customers. From local customers to customers from the international network of Grant Thornton International Ltd. All this diversity in customers can also be recognized in your customer package.

-

Culture

At Grant Thornton we combine a solid base with a flexible and results-driven mentality.

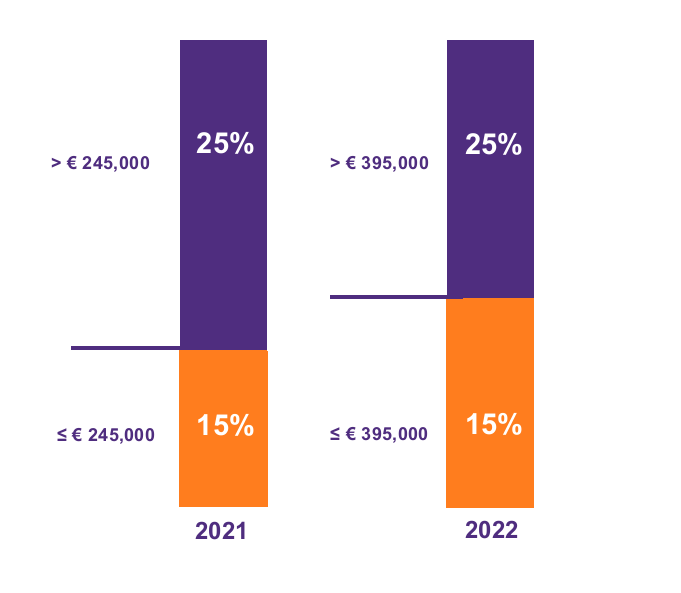

Corporate income tax rates

Currently, Dutch corporate income tax is levied through two profit brackets. In 2021, the first profit bracket applies to profits up to and including € 245,000 which are subject to a corporate income tax rate of 15%. All profits in excess of this amount are subject to a corporate income tax rate of 25%. According to previously announced plans, the profit threshold of the first corporate income tax bracket will be increased from € 245,000 to € 395,000 in 2022. Contrary, to some expectations, this reduction will go ahead in 2022.

Environmental investment allowance (MIA)

Dutch tax law includes an investment deduction for certain investments in environmentally friendly business assets. The government has decided to raise the deduction percentages. The previous rates were 13,5%, 27% and 36%. As of 1 January 2022, the rates will be raised to 27%, 36% and 45%.

Transfer pricing corrections

In the Netherlands, transactions between group entities should reflect a fair market value, i.e., need to be at arm`s length. In case a transaction is not in accordance with the arm`s length principle, a downwards or an upwards transfer pricing adjustment takes place at the level of the Dutch corporate income tax payer via an informal capital contribution or a deemed dividend distribution. However, in case the country of the related counterparty does not recognize such a transfer pricing adjustment, an international mismatch may occur which could result in e.g. a deduction without a pick up.

The legislative proposal specifies that as of 1 January 2022, the taxable profit of a Dutch taxpayer can no longer be adjusted downwards if the taxable profit of the other group company is not adjusted upwards accordingly. The legislative proposal also provides for a rule regarding the onshoring of assets from a group company to the Netherlands. In case the transferring company is not obliged to adjust the sales price of these assets to a fair market value, the Netherlands will refuse to provide a step-up to the fair market value of the assets at the acquiring company.

Reversed hybrid mismatches

Per 2020, the anti-hybrid mismatch rules of ATAD2 apply in the Netherlands with the exception of reversed hybrid mismatch rules. This rule will become effective as per 1 January 2022. A reverse hybrid entity is an entity (generally a partnership) that for tax purposes is considered transparent in its jurisdiction of incorporation/establishment, whereas the jurisdiction of one or more related participants qualifies the entity as non-transparent. In short, the reverse-hybrid measure aims to tackle the hybrid mismatch at the source by making the hybrid entity subject to tax. Effectively, a reverse hybrid entity will become subject to Dutch corporate income tax only to the extent that the profit is attributable to related participants that qualify the entity as non-transparent. Similarly, distributions by a reverse hybrid entity will only become subject to withholding tax to the extent the distribution is attributable to related participants that qualify the entity as non-transparent.

CFC-rules

Under the CFC-rules certain types of income derived by low-taxed foreign subsidiaries or permanent establishments are subject to corporate income tax at the level of the Dutch parent company. In case any profit tax is levied at the level of the CFC, these taxes can under conditions be credited with the Dutch corporate income tax which is levied at the level of the Dutch parent company.

However, the compensation of foreign profit taxes is maximized up to the Dutch corporate income tax payable in a financial year. Foreign profit taxes - which cannot be compensated as a result of this limitation – can be taken into account in the next financial year. The foreign profit tax which can be credited must be determined per CFC.

Currently, the Dutch corporate income tax act does not specify in which order the compensation of foreign profit taxes must take place. On Budget Day 2021, it is announced that the foreign profit taxes must be credited in order starting from the smallest amount.

Settlement of withholding tax with corporate income tax

The government plans to limit the settlement of dividend withholding tax and games of chance tax with corporate income tax. The cause of this limitation is a decision by the EU Court of Justice on 22 November 2018 (Sofina-ruling )

A Dutch receiving corporate shareholder can offset the dividend withholding tax (and games of chance tax) against its corporate income tax. In case the Dutch corporate shareholder is in a loss-making position for corporate income tax purposes, it can claim a full refund of the dividend withholding tax (and games of chance tax). This reclaim option is not available to foreign corporate shareholders. According to the EU Court of Justice this incompatible with EU law.

The government therefore has announced that the refund system will be replaced by a carry-forward of paid withholding taxes. Starting from 2022, the withholding taxes can only be offset against corporate income tax due in that financial year. The remaining withholding taxes can be carried forward indefinitely.

Other points for 2022

Loss compensation

Currently, all tax losses can be carried back for one year and can be carried forward for a period of six years. The government’s plan specifies that starting from 2022, tax losses can be carried forward indefinitely. However, the amount of losses which can be set-off will be limited. Profits up to € 1 million can be fully used to offset losses. In case the taxable profit exceeds €1 million, only 50% of the remaining taxable profit may be used to set-off losses. The losses which cannot be set-off may be carried forward indefinitely to the following years. The measure has been confirmed to apply from 1 January 2022.

Qualification of (foreign) partnerships

Earlier this year, the government announced that it will change the Dutch qualification rules for foreign partnerships. The aim of this change is to combat tax avoidance as a result of qualification mismatches. As a result of these changes, certain types of partnerships would be qualified differently than before. The government decided not to include this proposal in the Tax Plan 2022. As a result, the envisaged measure will not enter into force per 1 January 2022.