Future-proof business

The good news? You can be proactive. Building a climate strategy isn't just about environmental responsibility, it is about investing in a future-proof business. Here is why:

- Stay compliant. In 2015, a legally binding international treaty on climate change was adopted by 196 Parties, the Paris Agreement. Since then, agreements and regulations, such as the European Green Deal, the CSRD, CBAM and the upcoming CSDDD regulation, have been established to address climate change across industries. Having a climate strategy demonstrates your commitment to these regulations and helps avoid potential fines or operational shutdowns.

- Climate change costs money: The Intergovernmental Panel on Climate Change (IPCC), a leading international body for the assessment of climate change, warns that extreme weather events linked to climate change are already costing businesses billions of dollars annually. This trend is expected to worsen, impacting your supply chain, infrastructure, and overall operations.

- Consumers want sustainable brands: A 2022 study by IBM revealed that 50% of global consumers are willing to pay a premium for brands that prioritize sustainability. By acting on climate change, you tap into this growing market segment.

- Investors ask for climate action: Investors are increasingly seeking companies prepared for a changing climate to reduce risks and improve impact. A transparent climate strategy demonstrates your commitment to decarbonization, increases resilience and can attract valuable investment capital.

The link between the CSRD and building a resilient business

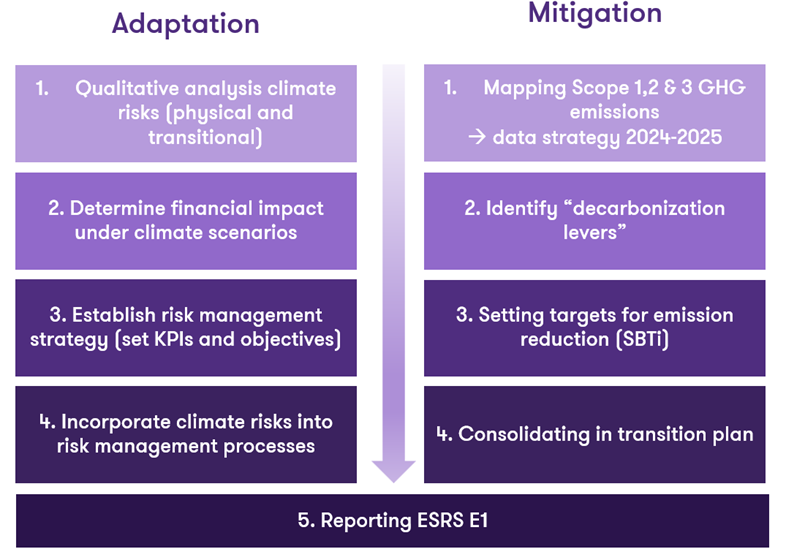

A solid climate strategy focuses on two key areas:

Climate mitigation: Reducing your company's negative impact on the environment by minimizing greenhouse gas emissions.

Climate adaptation: Preparing your business for the unavoidable impacts of climate change, such as extreme weather events.

The Corporate Sustainable Responsibility Directive (CSRD) requires companies to report on their climate strategy under the ESRS-E1 standard. This standard helps businesses to create insight in their emissions throughout the value chain and ensures transparent reporting. It also considers exposure to climate risks and potential business opportunities in different climate scenarios.

Developing a clear transition plan is crucial. This plan outlines your company's path towards reducing emissions and achieving your sustainability goals. It should include specific actions and strategies (called "decarbonization levers") to achieve these reductions. Finally, ensuring transparent governance processes demonstrates your commitment to managing both your impact on climate and your businesses risks and opportunities.

Ready to build your climate strategy?

Impact House supports you in every step of your climate assessment. We will help you develop a data-driven mitigation strategy aligned with the Greenhouse Gas Protocol, identify emission reduction opportunities, and set ambitious but achievable Science-Based Targets (SBTi).

Our extensive experience in climate risk modelling allows us to assess your vulnerabilities and the potential financial impacts on your operations, assets, and value chain. Together, we can create a practical transition plan that reduces your environmental footprint, strengthens your business resilience, and unlocks new business opportunities in a sustainable future.

Don’t know where to start? Let’s chat

A first assessment will provide valuable insights into your organization's current climate standing. We can then work together to prioritize actions and develop a plan that's right for your business.