Does EBITDA really tell the whole story?

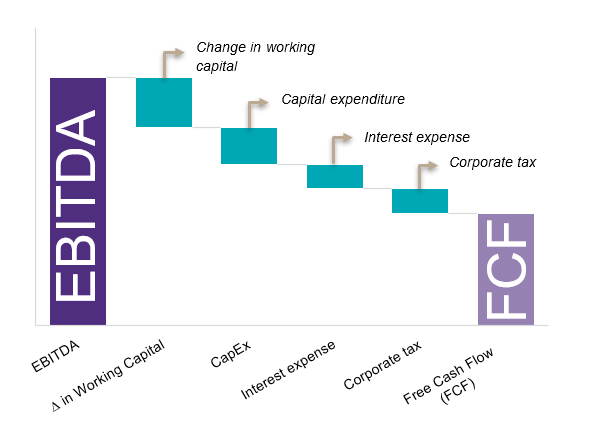

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) is often the go-to metric for evaluating a company's profitability. But here’s the catch: EBITDA is not cash flow. Many businesses appear strong on paper, boasting robust EBITDA, yet struggle with liquidity, hidden costs, and cash flow shortfalls.

The EBITDA trap: When profits don't convert to cash

A business can report high EBITDA while quietly struggling to meet its financial obligations. Why? Because EBITDA ignores:

- Working capital fluctuations: A company may stretch payables or accelerate receivables to inflate short-term cash flow. But what happens when these strategies become unsustainable?

- CapEx needs: Underinvestment in maintenance or upgrades can temporarily boost EBITDA and/or cash flow, but eventually leads to costly catch-up spending.

- Debt: EBITDA excludes interest and principal repayments, which directly affect a company’s cash position.

- One-time adjustments: Many companies present "adjusted EBITDA," adding back non-recurring costs. But are these truly one-time, or do they hint at ongoing cash flow problems?

- Non-operational cash movements: Legal settlements, restructuring costs, or changes in provisions are often ignored by EBITDA, but are still very real cash outflows.

- Taxes: EBITDA excludes taxes, which are a real and sometimes significant cash outflow.

Relying solely on EBITDA, without assessing cash conversion, can lead to overpaying for a business that may struggle to fund operations or sustain growth.

Possible red flags behind strong EBITDA

Even when EBITDA appears strong, it's crucial to dig deeper. Key cash flow risks often lurk beneath the surface:

- Deferred maintenance and underinvestment: Companies looking to sell often reduce capital expenditures to boost short-term results. But postponed investment can lead to costly breakdowns and future capital needs that eat into cash flow.

- Aggressive working capital tactics: A business might cut inventory levels or delay supplier payments to temporarily improve cash flow. After an acquisition, these tactics may reverse, creating an unexpected drain on liquidity.

- Debt-fueled growth: Growth driven by leverage may look profitable on paper, but can strain cash once repayments begin.

- Seasonality or timing mismatches: A snapshot of EBITDA might mask seasonal working capital swings or timing differences between revenue recognition and cash receipts/payments.

- High customer concentration: A large portion of EBITDA coming from one or two key customers can be risky, especially if contract terms are short or volume-based discounts apply.

- Under-resourced finance function: Weak financial controls or manual processes may lead to missed accruals, revenue leakage, or inaccurate reporting that distorts EBITDA quality.

- Pending or contingent liabilities: Legal claims, warranty exposures, or earn-outs not yet provisioned may not show up in EBITDA but will impact future cash flows.

Why Cash Conversion Matters in M&A

Smart buyers don’t just look at EBITDA; they evaluate how efficiently it converts into free cash flow. A business with strong EBITDA but weak cash flow may indicate:

- Operational inefficiencies

- Unsustainable working capital strategies

- Hidden liabilities or underreported costs

Key metric: Free cash flow conversion

A healthy business should generate strong free cash flow relative to EBITDA. If conversion is low, it’s a red flag that warrants further investigation.

What this means for valuation

Businesses with weak cash conversion often don’t justify high EBITDA multiples. Adjusting for real cash flows ensures a fair valuation and helps prevent post-acquisition surprises.

EBITDA is just the starting point

Relying on EBITDA alone is risky. A deep dive into cash flow, working capital, net debt and capital expenditures provides a clearer picture of financial health.

Whether you’re selling or acquiring, ask yourself: Does the EBITDA story match the cash reality?

Preparing to sell or evaluating an acquisition? Contact our Deal Advisory specialists to ensure EBITDA aligns with underlying cash flows and reflects the true financial health and value of the business.