Introduction

Under the new taxation rules, loans provided by affiliated companies to substantial interest shareholders will be classified as income for the shareholder if the loans exceed a threshold of EUR 700,000 at the reference date. The excess part of the loan will be subject to Dutch personal income tax at the level of the shareholder in Box 2. The applicable tax rate is 26.9% in 2023 and the first reference date will be set at 31 December 2023. As of 2024, there will be 2 rates in Box 2 of the income tax return: A base rate of 24.5% for income up to € 67,000 and a high rate of 31% on any excessive income.

Explanation of the new rules

Affected persons

These new rules apply to shareholders who directly and/or indirectly own a substantial interest (an interest of 5% or more) in a company and have a debt to that company exceeding EUR 700,000.

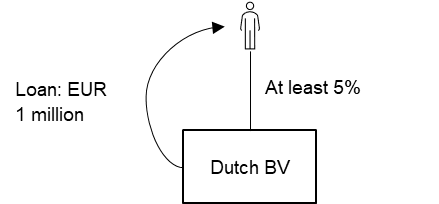

Example 1

Let's consider an example where a Dutch BV provides a loan of EUR 1 million to its substantial interest shareholder. On the 31st of December 2023, the shareholder needs to report EUR 300,000 as (fictitious) income in Box 2 for Dutch personal income tax purposes. This will result in a Dutch personal income tax liability of EUR 80,700 (26.9% x EUR 300,000).

These rules also apply when loans exceeding EUR 700,000 are provided to the substantial interest shareholder and their partner. Loans exceeding EUR 700,000 provided to (grand)parents and/or (grand)children of the substantial interest shareholder or their partner are also subject to the new taxation rules. The taxation on the excess loans takes place at the level of the substantial interest shareholder.

A substantial interest holder who is considered a tax resident outside the Netherlands but who owns a substantial interest in a Dutch tax resident company may also be subject to Dutch personal income tax (as a foreign taxpayer) with respect to loans provided by this Dutch tax resident company. A tax treaty concluded by the Netherlands and the country in which the substantial interest shareholder is resident (if any) may limit the possibility for the Dutch tax authorities to effectuate the new taxation rules.

Exception for loans used to purchase a house for personal use

Loans provided to a substantial interest shareholder, the partner of the shareholder, (grand)parents and/or (grand)children of the substantial interest shareholder or his/her partner to finance the purchase of a house for personal use are excluded from taxation. Loans provided as of 1 January 2023 should be secured by a mortgage in order for the exception to apply.

Qualifying loans

All loans provided by companies in which the shareholder directly or indirectly owns a substantial interest should be taken into account for the purpose of the new rules. No netting off receivables from and debt to affiliated companies is allowed. If a shareholder has debts to various affiliated companies, the amount of the loans is added up to determine the income to be reported in Box 2.

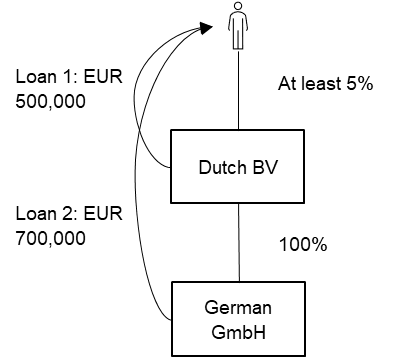

Example 2

In this example, Dutch BV and German GmbH provide loans of EUR 1.2 million to its substantial interest holder. On December 31st, 2023, the substantial interest holder needs to report EUR 500,000 as (fictitious) Box 2 income for Dutch personal income tax purposes. This will result is Dutch personal income tax liability of EUR 134,500 (26.9% x EUR 500,000).

Avoidance of double taxation

The amount of income reported in Box 2 is added up with the maximum amount of debt that can be owed by the substantial interest shareholder without taxation. A repayment of the excessive debt by the shareholder is treated as negative Box 2 income.

International aspects

Immigration

In the case of immigration, loans granted in the period before entering the Netherlands, do not qualify for the Excessive director's loan Act. A step up of at least € 700,000 will be granted. Consequently, no personal income tax is due with respect to loans provided to the substantial interest holder during the period that the shareholder was not a resident of the Netherlands.

Emigration

In case of emigration of a Dutch tax resident substantial interest holder outside the Netherlands, the Dutch tax resident substantial interest holder receives a protective assessment for the non-realized capital gain that can be attributed to the substantial interest owned. The levy of Dutch personal income tax due, only takes place at the moment of actual realization of the capital gain, which now also is deemed to occur if an excessive loan is provided by the affiliated company to the substantial interest shareholder after emigration.

Effect on other taxes

Essentially, the rules entail a reclassification of (part of) a loan to income. This only applies to Dutch personal income tax purposes. That means for example that no Dutch divided withholding tax is levied in relation to excessive debts of substantial interest holders that are classified as income for Box 2.

An exception exists nevertheless in relation to specific anti-abuse provisions that apply for corporate income tax purposes. Based on this anti-abuse provision, Dutch corporate income tax is due by a non-Dutch tax resident company with no relevant substance when income is derived from a substantial interest in a Dutch tax resident company and the shareholding is owned with the main purpose or one of the main to avoid Dutch personal income tax for another (i.e., a non-Dutch tax resident indirect substantial interest holder). As of 1 January 2023, income for these purposes also includes loans with an amount above EUR 700,000.

The 2023 Dutch corporate income tax rate is 19% for income below EUR 200,000. Income above this threshold is subject to a rate of 25.8%.

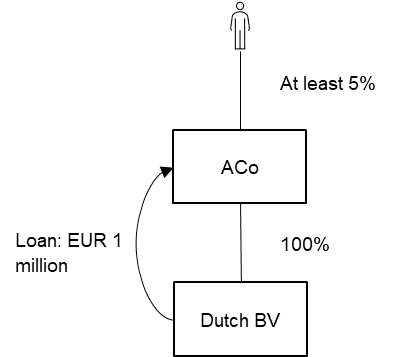

Example 3

In this example, Dutch BV provides a loan of EUR 1 million to its foreign substantial interest corporate shareholder (ACo, fiscal resident outside the Netherlands). On 31 December 2023, ACo needs to report EUR 300,000 as income for Dutch corporate income tax purposes provided that ACo does not have relevant substance and owns the interest in Dutch BV with (one of) the main purpose to avoid Dutch personal income tax for the indirect individual shareholder of Dutch BV.

This will result in a Dutch corporate income tax liability at the level of ACo of EUR 63,800 (19% of EUR 200,000 plus 25.8% of EUR 100,000).

If ACo is a resident of an EU Member State or a country that concluded a tax treaty with the Netherlands, it may however not be possible for the Dutch tax authorities to effectuate the new taxation rules.

How can we help?

Our tax specialist can discuss with you the impact of the new taxation rules on your specific situation.