Ownership is the quiet engine of any family business. It brings direction, commitment and long-term continuity. But it also raises questions: who decides, who takes responsibility, and how do you pass the baton effectively?

Especially when ownership, governance and family relationships are deeply intertwined, clear structure and alignment are essential. We support family businesses in shaping ownership that is both professional and futureproof.

Why ownership deserves attention

In many family businesses, ownership feels self-evident – until decisions must be made about succession, buyout or control. That’s when it becomes clear how important it is to define roles around ownership.

Common questions include:

- Should every shareholder have an active role in the business?

- How do we balance ownership and family relationships?

- What happens in the event of death or divorce?

- How do we prepare the next generation?

By opening up these questions before they become urgent, you create clarity and peace of mind. You’ll find answers to these and other questions further down this page.

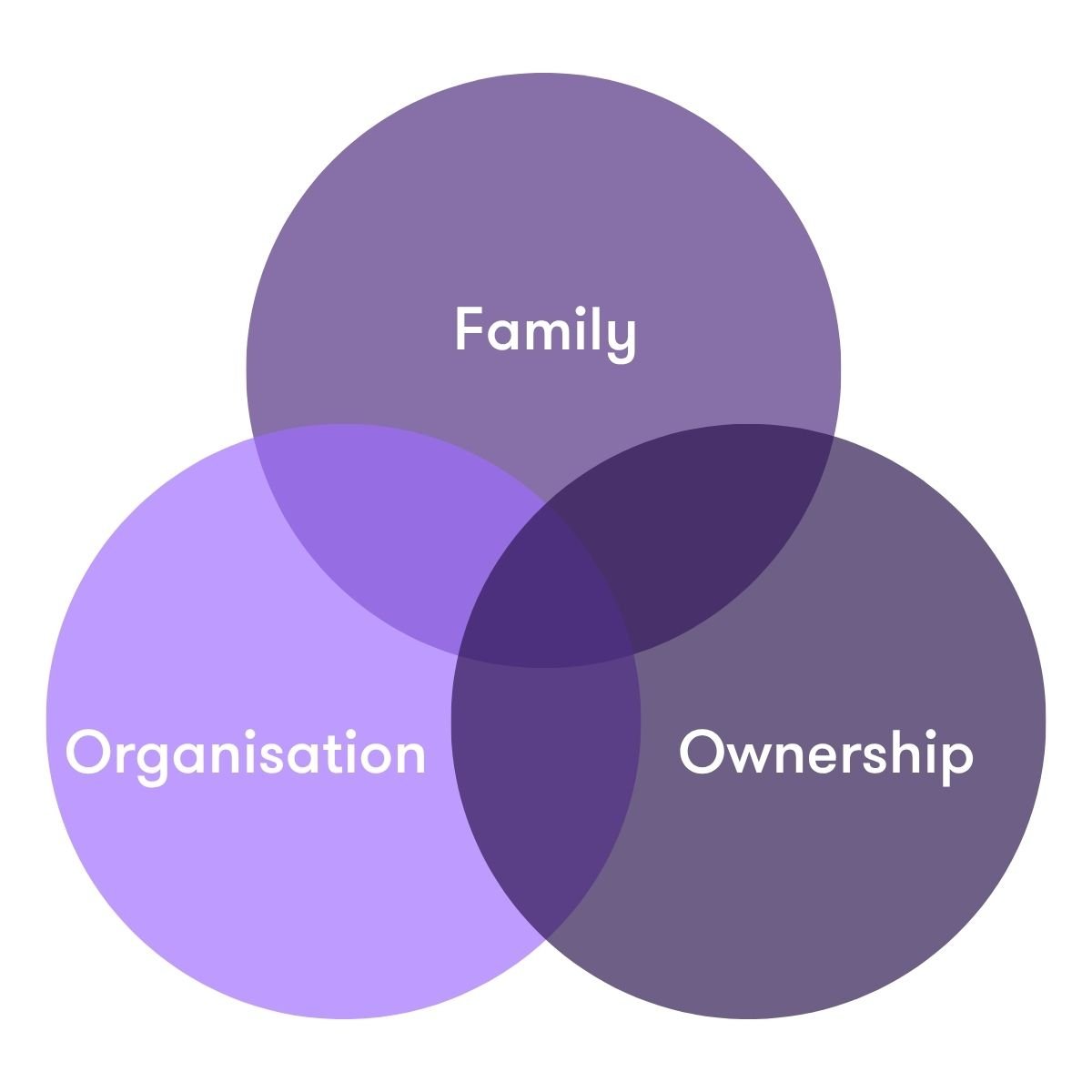

Clarity through the three-circle model

To organise ownership effectively, you need insight. The three-circle model helps distinguish between the three key roles in any family business:

- Family: who belongs to the family and feels connected?

- Ownership: who owns (a share of) the business?

- Business: who is actively involved in day-to-day operations?