-

Financial administration & outsourcing

Entrepreneurs who outsource financial administration reduce the number of administrative tasks and consequently have more time and space to focus on growth.

-

Financial insight

We help you turn financial data into valuable insights that support you in making well-founded decisions. In-depth analyses of your financial situation will help give you a better idea of where you stand and where the opportunities for growth lie, both in the short and long term.

-

Financial compliance

We make sure your company complies with financial legislation and regulations, with correct financial statements, tax reports and other obligations. From our global network, we support you in managing local and international tax risks.

-

Impact House by Grant Thornton

Building sustainability and social impact. That sounds good. But how do you go about it in the complex world of stakeholders, regulations and frameworks and changing demands from clients and society? How do you deal with important issues such as climate change and biodiversity loss?

-

Business risk services

Minimize risk, maximize predictability, and execution Good insights help you look further ahead and adapt faster. Whether you require outsourced or co-procured internal audit services and expertise to address a specific technology, cyber or regulatory challenge, we provide a turnkey and reliable solution.

-

Cyber risk services

What should I be doing first if my data has been kidnapped? Have I taken the right precautions for protecting my data or am I putting too much effort into just one of the risks? And how do I quickly detect intruders on my network? Good questions! We help you to answer these questions.

-

Deal advisory

What will the net proceeds be after the sale? How do I optimise the selling price of my business or the price of one of my business activities?

-

Forensic & integrity services

Do you require a fact finding investigation to help assess irregularities? Is it necessary to ascertain facts for litigation purposes?

-

Valuations

Independent and objective valuations tailored for mergers, acquisitions, and legal matters.

-

Auditing of annual accounts

You are answerable to others, such as shareholders and other stakeholders, with regard to your financial affairs. Financial information must therefore be reliable. What is more, you want to know how far you are progressing towards achieving your goals and what risks may apply.

-

IFRS services

Financial reporting in accordance with IFRS is a complex matter. Nowadays, an increasing number of international companies are becoming aware of the rules. But how do you apply them in practice?

-

ISAE & SOC Reporting

Our ISAE & SOC Reporting services provide independent and objective reports on the design, implementation and operational effectiveness of controls at service organizations.

-

International corporate tax

The Netherlands’ tax regime is highly dynamic. Rules and the administrative courts raise new challenges in fiscal considerations on a nearly daily basis, both nationally and internationally.

-

VAT advice

VAT is an exceptionally thorny issue, especially in major national and international activities. Filing cross-border returns, registering or making payments requires specialised knowledge. It is crucial to keep that knowledge up-to-date in order to respond to the dynamics of national and international legislation and regulation.

-

Customs

Importing/exporting goods to or from the European Union involves navigating complicated customs formalities. Failure to comply with these requirements usually results in delays. In addition, an excessively high rate of taxation or customs valuation for imports can cost you money.

-

Innovation & grants

Anyone who runs their own business sets themselves apart from the rest. Anyone who dares stick their neck out distinguishes themselves even more. That can be rather lucrative.

-

Tax technology

Driven by tax technology, we help you with your (most important) tax risks. Identify and manage your risks and become in control!

-

Transfer pricing

The increased attention for transfer pricing places greater demands on the internal organisation and on reporting.

-

Sustainable tax

In this rapidly changing world, it is increasingly important to consider environmental impact (in accordance with ESG), instead of limiting considerations to financial incentives. Multinational companies should review and potentially reconsider their tax strategy due to the constantly evolving social standards

-

Pillar Two

On 1 January 2024 the European Union will introduce a new tax law named “Pillar Two”. These new regulations will be applicable to groups with a turnover of more than EUR 750 million.

-

Cryptocurrency and digital assets

In the past decade, the utilization of blockchain and its adoption of a distributed ledger have proven their capacity to revolutionize the financial sector, inspiring numerous initiatives from businesses and entrepreneurs.

-

Streamlined Global Compliance

Large corporations with a presence in multiple jurisdictions face a number of compliance challenges. Not least of these are the varied and complex reporting and compliance requirements imposed by different countries. To overcome these challenges, Grant Thornton provides a solution to streamline the global compliance process by centralizing the delivery approach.

-

Private wealth services

Our Private Wealth specialists offer strategic and practical solutions. From tax advice to estate planning and financial scenarios, we make sure you make the right choices today, for tomorrow.

-

Corporate Law

From the general terms and conditions to the legal strategy, these matters need to be watertight. This provides assurance, and therefore peace of mind and room for growth. We will be pro-active and pragmatic in thinking along with you. We always like to look ahead and go the extra mile.

-

Employment Law

What obligations do you have with an employee on sick leave? How do you go about a reorganisation? As an entrepreneur, you want clear answers and practical solutions to your employment law questions. At Grant Thornton, we are there for you with clear advice, from contracts and terms of employment to complex matters such as dismissal or reorganisation.

-

Sustainable legal

At Grant Thornton, we help companies integrate sustainability into their business operations, with sustainable legal at the heart of our approach. We advise on ESG (Environmental, Social, Governance) legislation, and help draft sustainable contracts, implement HR policies, and carry out ESG due diligence in M&A transactions (Mergers and Acquisitions).

-

Pension advisory services

Are you, as business owner or employer, well prepared in terms of pension and other future facilities?

-

Global mobility services

How can you build and evolve a smart global mobility strategy, with policies and processes addressing the complex challenges of managing an international workforce?

-

Maritime sector

How can you continue to be a global leader? The Netherlands depends on innovation. It is our high-quality knowledge which leads the maritime sector to be of world class.

Background

In order to address the tax issues that arise from the increasing digitalization of economies, the OECD has been working on a Two-Pillar solution that reforms the current international taxation rules. The first (“Pillar 1”) seeks to shift tax on large digital service providers into the countries in which their sales take place. The second (“Pillar 2”) seeks to establish a minimum global tax rate.

Pillar one

At a very high level, Pillar 1 is intended to reallocate profits and related taxing rights from certain jurisdictions where multinational enterprises (MNEs) have physical substance to other countries where they have a market presence, regardless of whether or not they have a physical presence in that second jurisdiction.

The scope of Pillar One

Pillar one will apply to multinational enterprises with a global turnover above 20 billion euros and a profitability above 10% (i.e. profit before taxes). It is envisaged that this will operate as some type of digital sales/services tax (“DST”), with global technology giants falling within the rules.

Sectors of the extractive industry and regulated financial services are excluded from the scope.

After 7 years there will be a review to verify whether the new system was successfully implemented and achieved tax certainty. If so the global turnover minimum will be decreased to 10 billion euros.

Profit allocation under Pillar One

In order to determine the profit allocation to market jurisdictions, Pillar One uses two different formulas called:

- Amount A

- Amount B

Taxing rights on Amount A

Amount A allocates a share of the residual profits of a MNE to jurisdictions where the MNE has sales. This allocation is based on a formula, not the arm’s length principle.

The new taxing right would apply to 25% of the profit exceeding 10% of revenue (Amount A).

Amount A would be apportioned pursuant to a revenue-based allocation key between jurisdictions where the MNE realises at least EUR 1 million of revenue (for jurisdictions with a GDP below EUR 40 billion, a lower threshold of EUR 250,000 would apply).

Taxing rights on Amount B

Amount B provides a fixed return on certain basic marketing and distribution activities that take place in a certain jurisdiction.

Implementation

Amount A will be implemented through a multilateral instrument scheduled to be signed as of 2022 with entry into force in 2023. Unilateral measures, including digital services taxes, shall be removed.

The work on Amount B continues to be postponed to end of 2022. Moreover, no details on the specifics of Amount B or of its scope have been published.

Pillar two

Broadly, Pillar 2 is the global anti-base-erosion (“GLOBE”) regime which proposes to implement an agreed minimum effective tax rate of 15% in each country in which a MNE operates. The idea is that Pillar Two will end the race to the bottom.

Scope

The GloBE rules apply to multinational enterprises with a consolidated group revenue of at least EUR 750 million. However, countries are free to apply the IIR to MNE’s headquartered in their country even if they do not meet the threshold.

Furthermore, under certain circumstances a number of organizations will be exempt and are therefore not subject to the GloBE rules, such as investments funds, pension funds and real estate investment vehicles.

Key rules

Pillar Two consists of the following key rules:

- Two rules – together the Global anti-Base Erosion Rules (GloBE):

- Income Inclusion Rule (IIR)

- Under Taxed Payment Rule (UTPR)

- The Subject to Tax Rule (STTR)

- A Switch-Over Rule (SOR)

1. Global Anti-Base Erosion Rules (GloBE)

GloBE consists of two connecting domestic rules:

- An income Inclusion Rule (IIR), which imposes top-up tax on a parent entity in respect of the low taxed income of a constituent entity;

- An Undertaxed Payment Rule (UTPR), which denies deductions or requires an equivalent adjustment to the extent the low tax income of a constituent entity is not subject to tax under an IIR.

The GloBE rules will provide for an exclusion from the UTPR (under taxed payment rule) for MNE’s in the initial phase of their international activity. MNE’s in the initial phase are defined as:

- MNE’s that have a maximum of EUR 50 million tangible assets abroad; and

- that operate in no more than 5 other jurisdictions.

This exemption is limited to a period of 5 years starting from the moment the MNE’s fall into the scope of the GloBE rules. As such, MNE’s that fall into the scope at the time the GloBE rules come into effect will be subject to the UTPR 5 years from the time the UTPR comes into effect.

Carve-outs/safe harbours

The GloBE rules will contain a de minimis exclusion rule and a formulaic substance carve-out rule.

The de minimis rule excludes those jurisdictions where the MNE has revenues of less than EUR 10 million and profits of less than EUR 1 million.

The formulaic substance carve-out rule will exclude an amount of revenues representing the substance the MNE has in a jurisdiction.

2. Subject to tax rule (STTR)

The STTR will act as a withholding tax levy and will block treaty benefits when the payment is subject to a tax rate below the minimum rate of 9% at the level of the recipient. The STTR is meant to combat certain payments that present a high risk of profit shifting to low-tax jurisdictions. As such, the STTR applies to interest, royalties, and a defined set of other payments. The rule would apply to aforementioned payments made from a developing country to IF member States that apply a nominal corporate income tax rate below the STTR minimum rate of 9% to these payments. Moreover, the STTR shall take priority over the other rules.

The Switch-Over Rule (SOR)

In certain situations the IIR may be blocked by tax treaties. Therefore Pillar Two includes a switch-over rule to remove treaty blockades. If for example a tax treaty stipulates the parent jurisdiction to exempt the income of a permanent establishment that is established in a low-taxing State, the Switch-Over Rule allows for a switch from the exemption method to the credit method.

Implementation of Pillar two

Pillar two should be implemented in 2022 and is envisioned to take effect per 2023. The UTPR is scheduled to come into effect in 2024.

Examples

Hereafter we will discuss the above mentioned rules in depth with a few examples.

Example of the IIR

The ETR in State B amounts to 12% which is below the minimum of 15%. Therefore, the taxes levied under the IIR: EUR 30 (Sub1 GloBE tax base: 1,000 * 3%).

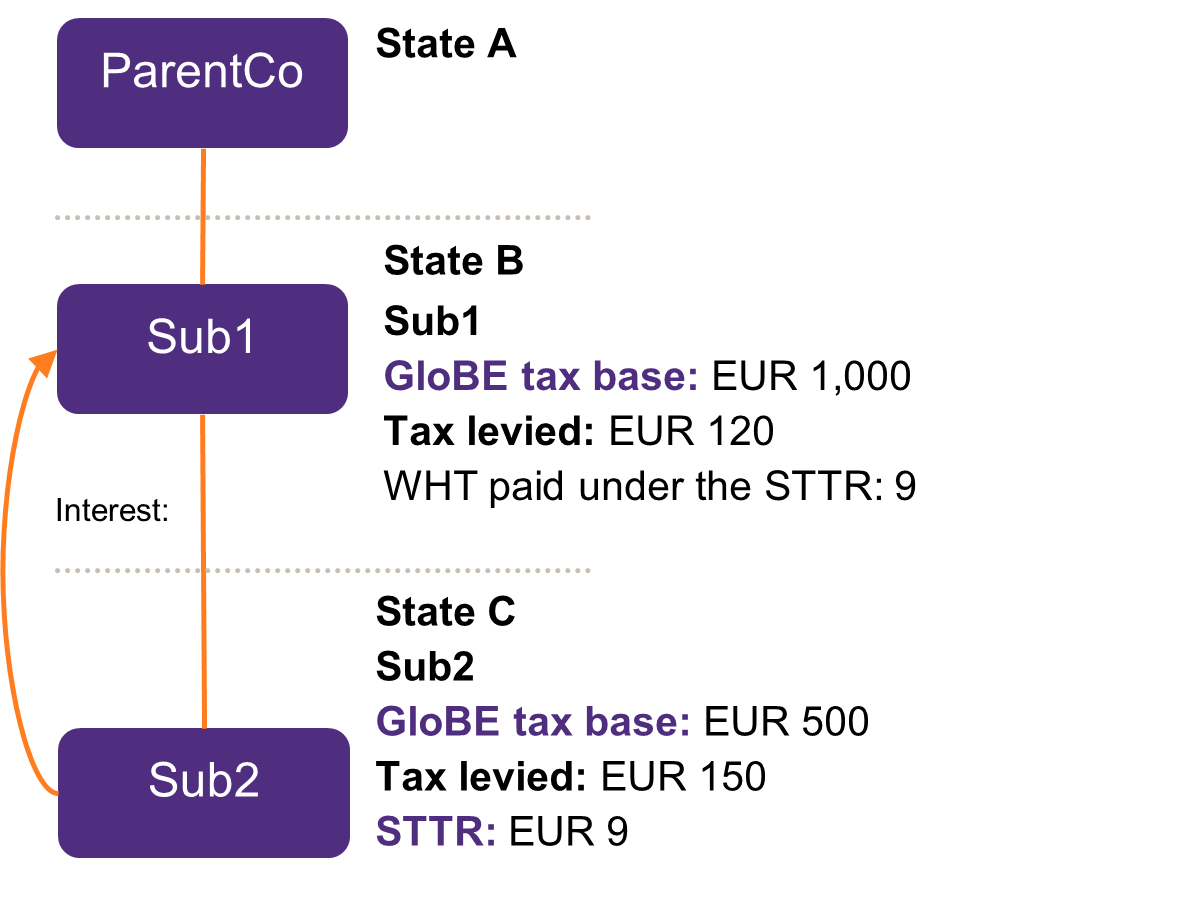

Example of the STTR

In this example we focus on State B and State C. In this case State B exempts any offshore income and State C qualifies as a developing country. Therefore, State C is authorized to impose additional tax on the interest at the rate equal to the difference between the corporate income tax levied with respect to the interest payment at the level of the recipient (0%) and the minimum rate under the STTR (9%).

Taxes under the STTR: EUR 9 (100*9%).

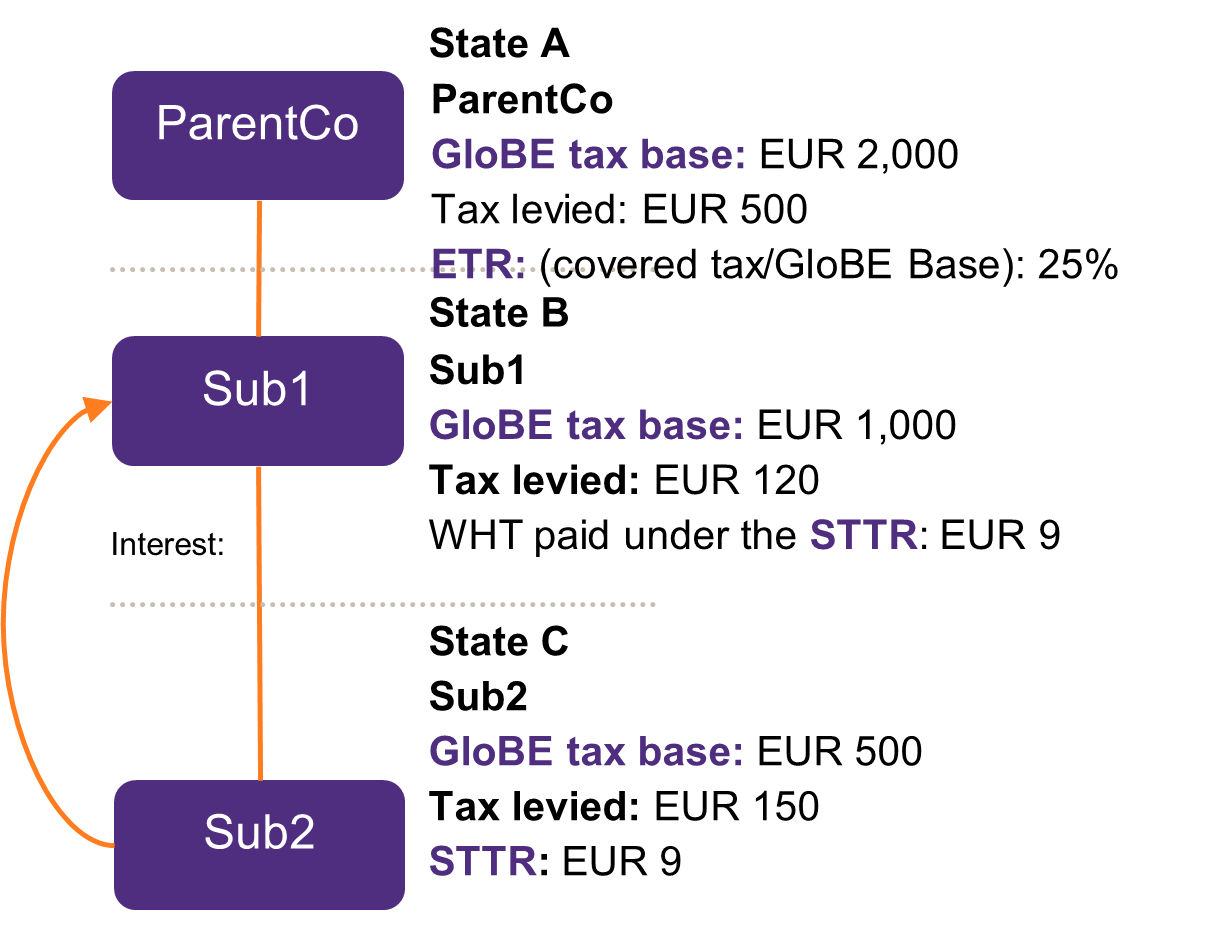

Example of UTPR

In this case State A has not introduced the IIR. State C qualifies as a developing country and has implemented the UTPR. State B exempts any offshore income.

Taxes under the STTR: EUR 9 (100*9%)

Therefore the ETR in State B amounts to 12.9%.

Taxes levied under the UTPR should amount to EUR 21 (Sub1 GloBE tax base: 1,000 * 2,1%) As such State C will deny the deduction of the interest under the UTPR up to: EUR 70 (21 / 30%).

Planning

The political pressure to come to an agreement by 2023 is high, however a significant amount of technical work as well as political work still remains. Therefore, implementing Pillar One and Two by 2023 seems to be ambitious.

Pillar One and Two aim to drastically change to landscape of international taxation and increase the complexity of the international tax system. This could have far reaching consequences for MNE’s that fall within the scope of Pillar One and Two.

We recommend to gather relevant information such as the effective tax rates per jurisdiction and make an assessment how Pillar One and Two have an impact on your business. Subsequently we recommend to make an impact assessment which could lead to rethinking the current structure.

Way forward

Of course we can assist you with the obligations arising from Pillar One and Two. We can help you with the assessment of the precise impact that Pillar One and two will have on your company as well as assist you with your compliance framework. We will keep you informed on any further developments and can help you in the complete process. Please contact us if you have any further questions.