-

Financial administration & outsourcing

Entrepreneurs who outsource financial administration reduce the number of administrative tasks and consequently have more time and space to focus on growth.

-

Financial insight

We help you turn financial data into valuable insights that support you in making well-founded decisions. In-depth analyses of your financial situation will help give you a better idea of where you stand and where the opportunities for growth lie, both in the short and long term.

-

Financial compliance

We make sure your company complies with financial legislation and regulations, with correct financial statements, tax reports and other obligations. From our global network, we support you in managing local and international tax risks.

-

Impact House by Grant Thornton

Building sustainability and social impact. That sounds good. But how do you go about it in the complex world of stakeholders, regulations and frameworks and changing demands from clients and society? How do you deal with important issues such as climate change and biodiversity loss?

-

Business risk services

Minimize risk, maximize predictability, and execution Good insights help you look further ahead and adapt faster. Whether you require outsourced or co-procured internal audit services and expertise to address a specific technology, cyber or regulatory challenge, we provide a turnkey and reliable solution.

-

Cyber risk services

What should I be doing first if my data has been kidnapped? Have I taken the right precautions for protecting my data or am I putting too much effort into just one of the risks? And how do I quickly detect intruders on my network? Good questions! We help you to answer these questions.

-

Deal advisory

What will the net proceeds be after the sale? How do I optimise the selling price of my business or the price of one of my business activities?

-

Forensic & integrity services

Do you require a fact finding investigation to help assess irregularities? Is it necessary to ascertain facts for litigation purposes?

-

Valuations

Independent and objective valuations tailored for mergers, acquisitions, and legal matters.

-

Auditing of annual accounts

You are answerable to others, such as shareholders and other stakeholders, with regard to your financial affairs. Financial information must therefore be reliable. What is more, you want to know how far you are progressing towards achieving your goals and what risks may apply.

-

IFRS services

Financial reporting in accordance with IFRS is a complex matter. Nowadays, an increasing number of international companies are becoming aware of the rules. But how do you apply them in practice?

-

ISAE & SOC Reporting

Our ISAE & SOC Reporting services provide independent and objective reports on the design, implementation and operational effectiveness of controls at service organizations.

-

International corporate tax

The Netherlands’ tax regime is highly dynamic. Rules and the administrative courts raise new challenges in fiscal considerations on a nearly daily basis, both nationally and internationally.

-

VAT advice

VAT is an exceptionally thorny issue, especially in major national and international activities. Filing cross-border returns, registering or making payments requires specialised knowledge. It is crucial to keep that knowledge up-to-date in order to respond to the dynamics of national and international legislation and regulation.

-

Customs

Importing/exporting goods to or from the European Union involves navigating complicated customs formalities. Failure to comply with these requirements usually results in delays. In addition, an excessively high rate of taxation or customs valuation for imports can cost you money.

-

Innovation & grants

Anyone who runs their own business sets themselves apart from the rest. Anyone who dares stick their neck out distinguishes themselves even more. That can be rather lucrative.

-

Tax technology

Driven by tax technology, we help you with your (most important) tax risks. Identify and manage your risks and become in control!

-

Transfer pricing

The increased attention for transfer pricing places greater demands on the internal organisation and on reporting.

-

Sustainable tax

In this rapidly changing world, it is increasingly important to consider environmental impact (in accordance with ESG), instead of limiting considerations to financial incentives. Multinational companies should review and potentially reconsider their tax strategy due to the constantly evolving social standards

-

Pillar Two

On 1 January 2024 the European Union will introduce a new tax law named “Pillar Two”. These new regulations will be applicable to groups with a turnover of more than EUR 750 million.

-

Cryptocurrency and digital assets

In the past decade, the utilization of blockchain and its adoption of a distributed ledger have proven their capacity to revolutionize the financial sector, inspiring numerous initiatives from businesses and entrepreneurs.

-

Streamlined Global Compliance

Large corporations with a presence in multiple jurisdictions face a number of compliance challenges. Not least of these are the varied and complex reporting and compliance requirements imposed by different countries. To overcome these challenges, Grant Thornton provides a solution to streamline the global compliance process by centralizing the delivery approach.

-

Private wealth services

Our Private Wealth specialists offer strategic and practical solutions. From tax advice to estate planning and financial scenarios, we make sure you make the right choices today, for tomorrow.

-

Corporate Law

From the general terms and conditions to the legal strategy, these matters need to be watertight. This provides assurance, and therefore peace of mind and room for growth. We will be pro-active and pragmatic in thinking along with you. We always like to look ahead and go the extra mile.

-

Employment Law

What obligations do you have with an employee on sick leave? How do you go about a reorganisation? As an entrepreneur, you want clear answers and practical solutions to your employment law questions. At Grant Thornton, we are there for you with clear advice, from contracts and terms of employment to complex matters such as dismissal or reorganisation.

-

Sustainable legal

At Grant Thornton, we help companies integrate sustainability into their business operations, with sustainable legal at the heart of our approach. We advise on ESG (Environmental, Social, Governance) legislation, and help draft sustainable contracts, implement HR policies, and carry out ESG due diligence in M&A transactions (Mergers and Acquisitions).

-

Pension advisory services

Are you, as business owner or employer, well prepared in terms of pension and other future facilities?

-

Global mobility services

How can you build and evolve a smart global mobility strategy, with policies and processes addressing the complex challenges of managing an international workforce?

-

Maritime sector

How can you continue to be a global leader? The Netherlands depends on innovation. It is our high-quality knowledge which leads the maritime sector to be of world class.

What is the situation regarding the VBAR bill?

The bill that aims to clarify the distinction between being self-employed and being an employee is currently before The Council of State for advice. An earlier version received a lot of criticism. The Dutch Social Affairs Minister, Eddy van Hijum, will pursue an amended version of the bill. This is evident from the new cabinet's Outline Agreement. The parliamentary discussion of the bill will take a while and the bill will therefore not be enacted until 2026.

What should you look out for with the tighter controls from 1 January 2025?

Because the Tax Administration will already increase its checks on bogus self-employment from 1 January 2025, it is a good idea to assess now whether you are dealing with a "real" self-employed person or whether an employment agreement may be in place after all. After all, working with self-employed people is not without risk.

How will future legislation define whether someone is genuinely self-employed?

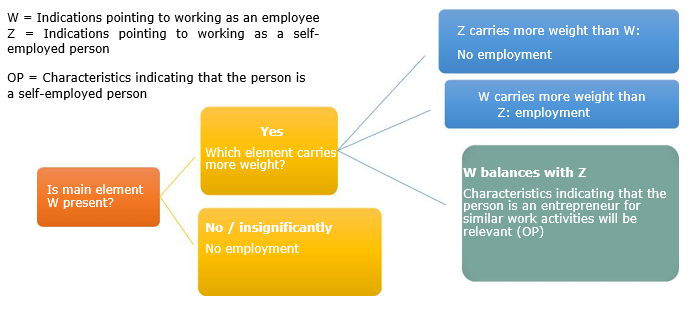

The VBAR bill determines whether a person is self-employed or there is an employment agreement, based on the following elements and indications which they compare and take into account:

- Characteristic W

Indicates the existence of an employment agreement. - Characteristic Z

Is a contraindication and indicates independent work at one's own expense and risk. - OP characteristics

Point towards the fact that the person as an economic actor is an entrepreneur.

If W and Z are both present to a similar or limited extent, then the OP characteristics (the person's present entrepreneurship) may be the deciding factor.

If W and Z carry equal weight, then the legislator looks at whether the worker behaves as an entrepreneur in society (OP). If the worker does not usually behave as an entrepreneur in the economic sphere when performing similar work, then there is an employment agreement.

What indications does the legislator use when checking for bogus self-employment?

|

W

|

Indications pointing to working as an employee (work-related control and organisational management):

|

|

|

Z

|

Indications pointing to working

as a self-employed person within the employment relationship (working at one’s own expense and risk): |

|

|

OP

|

Characteristics indicating

that the person is an entrepreneur (outside the labour relation under scrutiny) for similar work activities: |

In this respect, you can think of, for example:

|

What does the check for bogus self-employment look like schematically?

The draft of the explanatory memorandum shows the weighting of the elements schematically as follows:

What does the check for bogus self-employment look like in practice?

Using some case studies, we will show you how these indications and characteristics work out in practice. Please note that applying these cases one-to-one to real-life situations is difficult because facts and circumstances per case are almost never exactly the same. If those facts and circumstances change, then the outcome may also change. The following principle always applies: substance over form. And if the actual situation is different from the one on paper, then the actual situation will be the starting point for the assessment.

- The healthcare provider sets his or her own rate and has taken out liability insurance policies.

- The clients are hospitals that the care provider chooses.

- The hospital determines the work done by the care provider.

- This work is a core activity of the hospital and structural in nature.

- The hospital may question the way the care provider interprets patient care.

- There is some autonomy, but there are also strict general protocols/instructions on how care providers works (e.g. they are not allowed to use their own materials).

- There are also instructions as to how the care provider should present himself or herself and behave within the organisation.

- Care providers have a say in their working hours.

- There are no result-oriented obligations.

- There is no specific knowledge or experience that is not structurally present in the organisation.

Based on this information, we can conclude that:

There is 'work-related control and organisational management' because:

- There are strict protocols and instructions.

- Activities are structural and other employees also perform them.

- There is an organisational framework to which the care provider must adhere.

To some extent there is 'working at your own expense and risk' because:

- The financial risks and outcomes are not with the care provider.

- The care provider is not responsible for the materials.

- There is no specific knowledge or experience that is not structurally present in the organisation.

The elements pointing towards 'authority' are unmistakably present.

Conclusion

There are two employment agreements with both hospitals.

- Each year, an actor supervises year eight for the end-of-year musical.

- Besides this work, this actor does other work for various clients and he has his own website.

- The actor should be with the class at agreed times.

- There are guidelines for the content of the musical because of the school's identity.

- The actor works on the musical together with the teacher of year eight.

- The actor further determines the content of the work.

- The actor may present himself to students and parents as an actor working independently.

- The actor has no liability insurance policies.

Based on this information, we can conclude that:

To a very small extent, there is 'work-related control and organisational management', because:

- The actor has a lot of freedom to determine the content of the work.

- The result produced by the actor is paramount (a result-oriented obligation).

- It does not involve structural work (the actor does not work alongside employees).

- The actor does have to keep to agreed times.

There are very few elements that can be construed as 'work-related control and organisational management', because:

- There is no exercise of authority.

- The Tax Administration does not have to look at the contraindications of 'working at your own expense and risk'.

Conclusion

There is no employment agreement.

- A teacher of Spanish gets hired at a school for six hours a week.

- The teacher uses the school's prescribed teaching methods and materials.

- He abides by internal rules and is present at the times stipulated by the school.

- The school discusses his performance with him annually (some kind of appraisal).

- The teacher also gives exam training from a company registered with the Chamber of Commerce and regularly takes on translation jobs.

Based on this information, we can conclude that:

There is to a large extent 'work-related control and organisational management' because:

- The teacher must adhere to the teaching methods prescribed.

- He is subject to a performance review.

- Teaching involves structural work (other workers also do this).

- He must adhere to the internal rules and agreed working hours.

There is no question of 'working at your own expense and risk' because:

- The risk of the result of his work (he does not teach or does not teach well) lies with the school.

- The teacher himself or herself is not at risk, or only to a very limited extent, with regard to the outcome of his or her work.

Conclusion

There is an employment agreement with the school in respect of working as a teacher of Spanish. This disregards the examination training and translation jobs that the self-employed teacher can do outside this employment agreement.

- A decorator helps a decorating business.

- The decorator is part of a team (of employed decorators) working on a large house painting job.

- The decorator was asked because of his specific knowledge and skills related to painting and restoring older buildings and, in particular, the restoration of the ceiling ornaments.

- If the decorator fails to deliver the ceiling ornaments in good condition, he will not get paid. To get paid after all, the decorator must do the work again, but at his own expense.

- All decorators work together in the team, but this decorator is responsible for a specific part (the ornaments) because of his specific expertise.

- The decorator is given the same instructions as the rest of the team for some of the work. For the ornaments, he is given considerable autonomy.

- The decorator has no performance reviews and brings his own tools and materials (specifically suitable for ornaments).

- The decorator has a large number of clients and his own website.

- He uses his own van which bears his name and his company's logo.

- The decorator is registered with the Chamber of Commerce, is a VAT registered entrepreneur and has been entitled to the self-employed person’s deduction for years.

Based on this information, we can conclude that:

There is definitely 'organisational management' and limited 'work-related control' because:

- The decorator can receive instructions on how to do the work but is given considerable freedom to do the work on the ornaments as he sees fit.

- There is no monitoring, such as performance reviews.

- However, it is obvious that there is organisational management (the house painting involves structural work and there are employees who also do house painting work).

There is also undeniably an element of 'working at your own expense and risk' because:

- The decorator is responsible for the result to be delivered and runs financial risks.

- He has specific skills.

- Uses his own tools and materials.

- The assignment is of short duration.

There seems to be more or less a balance between 'work-related control' and 'organisational management' on the one hand and 'at your own expense and risk' on the other. Both elements are prominently there and carry equal weight.

Then the legislator looks at (OP) - whether the worker usually behaves as an entrepreneur in his professional activities. This is indeed the case because:

- He has a wide range of clients.

- He has his own website.

- He has made business investments.

- Administratively, he behaves as an independent contractor.

Conclusion

There is no employment agreement.

- A management consultant is regularly hired to outline reorganisations, draw up an action plan for this purpose and (if necessary) guide its implementation.

- He finds his own clients.

- For larger companies, assignments take a bit longer, for smaller companies it can be done more quickly.

- The action plan is subject characterised by a result-oriented obligation.

- The consultant is free to choose how he put this plan of action into practice.

- There is no substantive direction from these organisations. As to the implementation of the guidance, this is a bit more diffuse, but ultimately the work stops after implementation.

- The consultant has an e-mail address from the organisation for which he is supervising the reorganisation and he must stick to the working hours that apply in the company.

- Payment depends on the success of the reorganisation.

Based on this (limited) information, we can conclude that:

There is little or no 'work-related control and organisational management' because:

- The consultant is not instructed (the obligation to achieve results is what matters most).

- The work is not structural and he does not perform it along with employees.

- It does to some extent involve work within the organisational framework, namely: the working hours and the use of an email address of the organisation.

The elements that relate to 'work-related control and organisational management' are few. Therefore, there cannot be an employment agreement and the Tax Administration does not need to look at the elements related to 'working at your own expense and risk'.

Conclusion

There is no employment agreement.

- An interim manager is hired by an organisation as a manager when one of its managers in employment is incapacitated.

- The interim manager is highly experienced and can therefore step in quickly.

- The interim manager is responsible for staff, the equivalent of about 25 FTEs.

- The culture of the organisation is to leave managers relatively free and operate autonomously as long as production is maintained.

- However, the organisation is expressly authorised to give directions.

- The interim manager adheres to the organisational frameworks in place and operates within them.

- In general, the interim manager has two or three full-time jobs per year for several months per assignment.

Based on this information, we can conclude that:

There is clearly an element of 'work-related control and organisational management' because:

- Despite the freedom given to the interim manager, others do have the authority to give directions and instructions.

- There is structural work.

- He carries out the work in tandem with managers who are on the payroll.

- There is an organisational framework to which the manager must adhere.

There is only a limited degree of 'working at one's own expense and risk' because:

- The risks lie with the client.

- There is no unique knowledge that is not structurally present in the organisation.

- Nor is the worker (outwardly) recognisable as a self-employed, independent person.

- There is an assignment of a relatively short duration (compared to the usual term of a management position).

The degree of 'work-related control and organisational management' clearly outweighs the degree of 'working at one's own expense and risk'.

Conclusion

There is an employment agreement.

- Three employees left the same construction company in quick succession.

- The order book is full, so they need to find new employees at short notice.

- The company tries to recruit new employees but is only partially successful (one new employee and one trainee).

- Therefore, the company approached a self-employed person known to them to help them out temporarily (about 2 months) on construction projects already under way, for two days a week.

- This self-employed worker can work for this construction company two days a week by mutual agreement.

- He is given his own specific assignment: installing the kitchens in a new housing project.

- In this case, the self-employed worker performs the work alone and is responsible for delivering it in accordance with the assignment and on time.

- During those two months, he uses his own van (with his name and logo on it) and his own tools.

- The construction company purchases the building materials for the projects the self-employed person works on.

- The self-employed worker is in charge of his own working hours, although he has agreed to announce when he will be on the job, to allow coordination of work and presence on site by the construction company.

- The self-employed worker sends monthly invoices based on the actual number of hours multiplied by his hourly rate (50 euros, excluding VAT).

- He gets specific assignments. If he does not complete these assignments satisfactorily, he must return to the project and finish it at his own expense.

- If he causes damage during the work, he must compensate the construction company for the costs.

- He has liability insurance.

- For several years, he has been known to the tax authorities as a sole trader for sales tax and income tax.

Based on this information, we can conclude that:

There is a degree of 'work-related control and organisational management' because:

- Structural work is involved.

- The construction company has employees doing the same job.

- The company manages the self-employed person to a limited extent.

However, there is also a clear case of 'working at your own expense and risk' because:

- The self-employed person is responsible for a specific assignment.

- He is at risk if he does not work or does not achieve the agreed result.

- He has to improve shortcomings in the result and pay for damages at his own expense.

- He works with his own tools.

- The self-employed worker trades under his own name (he has his own van, with his name and logo on it).

- It is a short-term assignment.

There seems to be a balance between 'work-related control and organisational management' on the one hand and 'working at one's own expense and risk' on the other. Therefore, the Tax Administration must assess whether the self-employed person usually behaves as a trader. This seems to be the case because:

- He has been self-employed for years.

- He has his own client portfolio.

- He has several clients per year.

- He has made business investments (his own van and tools).

- Administratively, he behaves as an independent contractor.

Conclusion

There is no employment agreement.

- An HR specialist is hired to prepare a report on an upcoming reorganisation aimed at reducing departmental costs.

- The specialist is free to decide how this report is produced, as long as it meets the preconditions outlined by the client in the assignment.

- To this end, the HR specialist enters into an agreement with the client for sixteen hours a week for six months.

- A successful reorganisation means that the job is finished.

- After five months, one of the client's part-time HR employees (twenty hours a week) develops a long-term condition.

- The client asks the HR specialist to take over the work of the sick employee (mainly absence registration and attending and recording talks about employment terms in coordination with the head of HR).

- The HR specialist takes over this work for twelve months, working subject to the same terms and within the same team as the afflicted employee.

Based on this information, we can conclude that:

In the first assignment, there is no 'work-related control and organisational management' because:

- The employer does not have the ability to give instructions on how the HR specialist should do the job.

- The employer cannot make substantive adjustments to the work other than on the basis of the result to which the HR specialist has committed (the result-oriented obligation is key).

- It does not involve structural work and there are no employees doing the same work.

In this first assignment, there are insufficient elements of 'work-related control and organisational management' to assume there is an employment agreement.

In the second assignment (taking over the work of the sick employee), there is definitely 'work-related control and organisational management' because:

- The HR specialist carries out the work in coordination with the head of HR.

- The head of HR can give instructions and monitor the work

- The structural work is the work that the specialist performs side-by-side with other HR employees.

Taking over the work of the absent employee does not involve 'working at his own expense and risk' because:

- The risks lie with the client.

- There is no specific knowledge that is not structurally present within the organisation.

- The worker cannot be recognised as a self-employed person, not even for limited duration and scope (short-term assignment).

Conclusion 1

For the first assignment, there is no employment agreement.

Conclusion 2

Taking over the work of the sick employee creates an employment agreement for this part of the work.

- An educationalist (pedagogical professional) is hired by a childcare organisation.

- This professional determines the rate.

- The work of the professional consists of caring for, educating and/or contributing to the development of children.

- The professional must adhere to the childcare organisation's pedagogical policy plan. For example, following the daily rhythm set out in the pedagogical policy plan.

- A manager supervises the performance of the professional with regard to the tasks and may give instructions.

- The professional receives the same instructions as the employees of the childcare organisation.

- There is an obligation of effort regarding the work to be performed, not a result-oriented obligation.

- There is no specific knowledge or experience that is not structurally present in the organisation.

Based on this information, we can conclude that:

There is clearly an element of 'work-related control and organisational management' because:

- The organisation gives instructions and a manager supervises.

- The professional must adhere to working hours and the organisation's policy plan.

- The structural work involves the educationalist working alongside employees.

There is only a very limited degree of 'working at one's own expense and risk' because:

- The only indication of this is that the pedagogical professional determines the rate.

In assessing the nature of the labour relation, there are more and weightier elements present pointing to working within an employment context than there are elements of self-employment.

Conclusion

There is an employment agreement.

- Two independent designers both work in a creative hub.

- Their workplaces are adjacent.

- They each have their own, independent practice.

- They have their own websites, their own advertising, they rent their hub workshops independently, acquire their own assignments independently and make investments in their own materials, tools and so on.

- In the hub, there is an informal agreement that designers can call on another designer from the hub to help with an assignment.

- Designer One took on an assignment to develop a corporate identity for a small SME.

- In practice, this assignment turns out to be too big for him to finish on time and according to agreements made with the client company.

- Therefore, he hires Designer Two to help him with the accepted assignment.

- Designer One remains ultimately responsible for the deliverable final result of the overall assignment.

- He therefore gives instructions on the final result that Designer Two should produce and also on style to be used in the process.

- Otherwise, he leaves Designer Two free to decide how to carry out the assignment.

- A fixed total amount was agreed for this after negotiation between the two designers.

- Designer Two uses his own materials and tools to do his part of the job.

- If the final result delivered by Designer Two does not meet the agreed requirements, he must return to the project to get it up to the required standards it - at his own expense.

Based on this information, we can conclude that:

There is only a limited extent of 'work-related control and organisational management' because:

- Even if they are given instructions, these are limited to the result they have to deliver.

- It involves structural activities.

- They do not perform the work in conjunction with employees doing similar work.

There is certainly an element of 'working at your own risk and expense' because:

- The rate was negotiated.

- Designer Two bears the financial risks or results of this assignment.

- Designer Two uses his own materials.

In assessing the nature of the labour relation, there are more and weightier elements present that point to 'working at one's own expense and risk'.

Conclusion

There is no employment agreement

- A meal delivery driver regularly works a varying number of hours a week for a platform company.

- When he wants to work, he logs into the app and then receives instructions based on an algorithm regarding the meals to be delivered.

- The idea is that the faster he works or the longer he works, the more offers he gets.

- In doing so, he is free to choose when he wants to work and whether he wants to be replaced by another driver if necessary.

- For this, he uses his own bike and gets to choose his own clothes.

- The meal delivery driver works only for this platform and although it is allowed, he chooses not to be replaced.

- The delivery driver gets paid for each delivered meal.

Based on this information, we can conclude that:

There is 'work-related control and organisational management' because:

- The delivery driver is given directions and instructions.

- The client checks the work.

- Delivering meals is structural work that other workers also do.

To some extent there is 'working at your own expense and risk' because:

- The worker is responsible for his own materials (the bicycle).

The degree of 'work-related control and organisational management' and 'embedding in the organisation' clearly outweighs the degree of 'working at one's own expense and risk'.

Conclusion

There is an employment agreement.

Want to know more?

Please contact our specialists. They are here to help you.